child care tax credit calculator

Have been a US. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility.

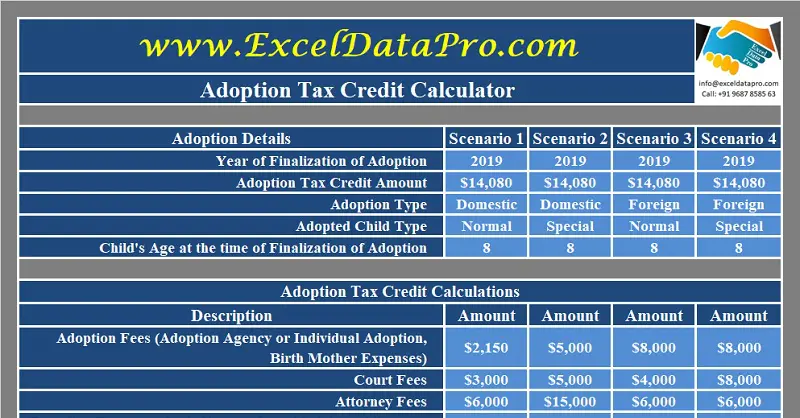

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

If you get Tax-Free Childcare the government will pay 2 for every 8 you.

. Try Our Free Tax Refund Calculator Today. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit. Ad Search Smart - Find Child Care Tax Credit Compare Results.

Free childcare for children aged between 2 and 4. Child and family benefits calculator. The Child and Dependent Care Credit can be worth from 20 to 35 of some or all of the dependent care expenses you paid.

Child and Dependent Care Credit Value. State Aid Claim Year FTE Calculator Year. You can use this calculator to see what child.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Tax credits calculator -. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and.

The IRS is no longer issuing these advance payments. The payments for the CCB young child supplement are not reflected in this calculation. The percentage you use.

The Ontario Child Care Tax Credit is calculated as a percentage of your Child Care Expense Deduction. Estimate Your 2021 Child Tax Credit Advance Payments. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022.

Claim the Child Tax Credit in 2022 by e-filing your 2021 Tax Return on. Use this calculator to find out how much you could get towards approved childcare including. Compare Answers Top Search Results Trending Suggestions.

Find Child Care Tax Credit. Discover Helpful Information And Resources On Taxes From AARP. The Child Care Expense Deduction provides provincial and federal income tax.

You can get up to 500 every 3 months 2000 a year for each of your children to help with the costs of childcare. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. Ad No Matter What Your Tax Situation Is TurboTax Has You Covered.

2022-23 Combined FTE Calculator. Help with childcare costs if your child is. Our Premium Calculator Includes.

Helping You Avoid Confusion This Tax Season. Our Premium Calculator Includes. 2021-22 Combined FTE Calculator.

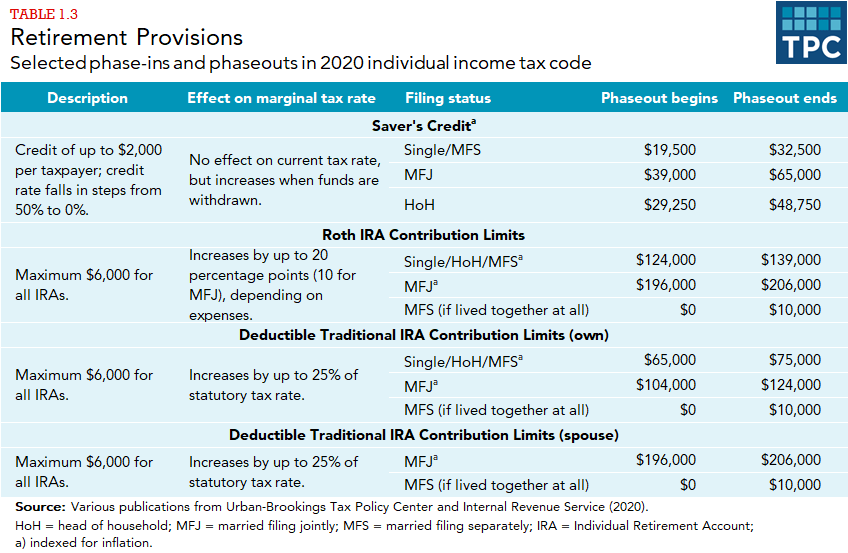

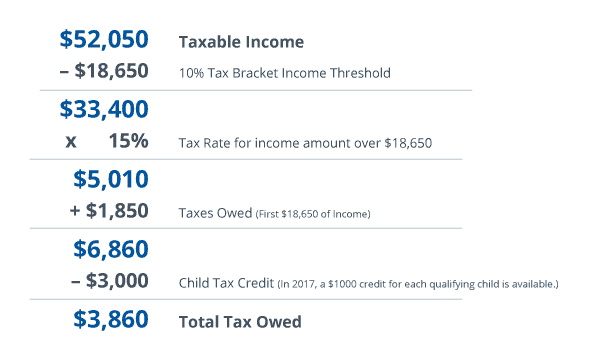

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

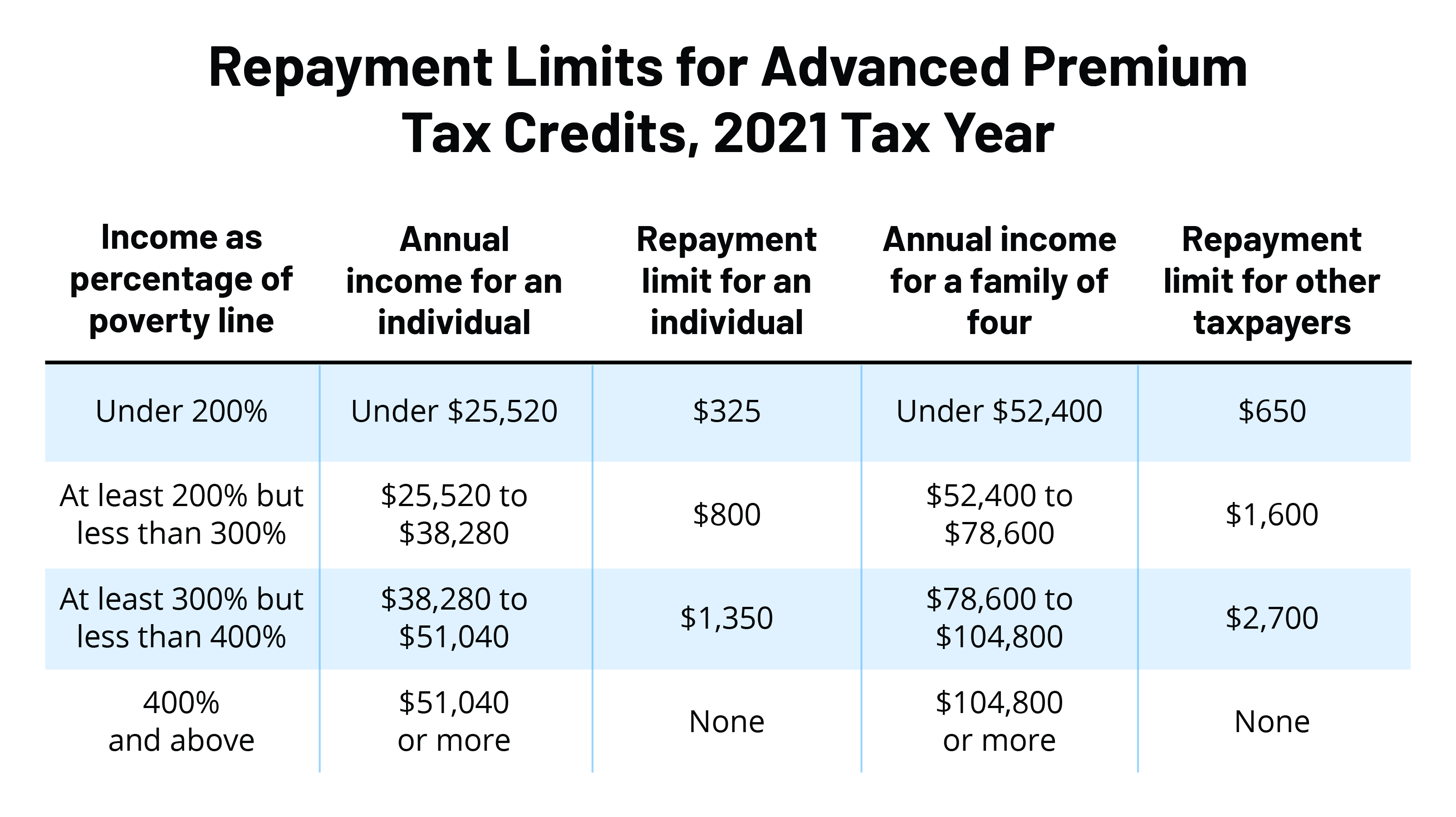

2021 Health Insurance Marketplace Calculator Kff

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Standard Deduction Tax Exemption And Deduction Taxact Blog

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Calculating The Hidden Cost Of Interrupting A Career For Child Care Center For American Progress

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

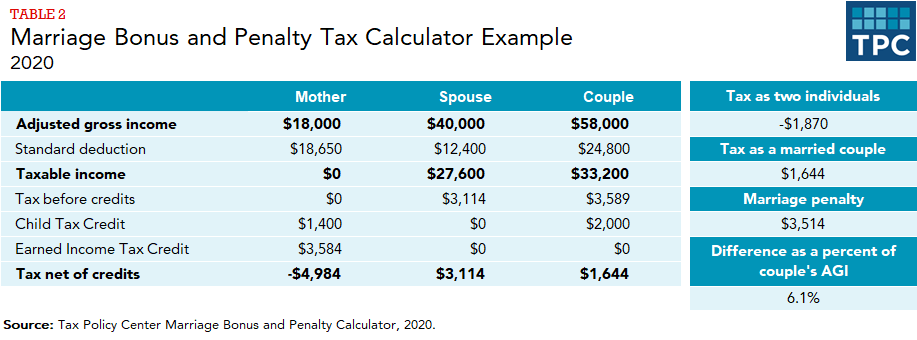

What Are Marriage Penalties And Bonuses Tax Policy Center

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Child Tax Credit Schedule 8812 H R Block

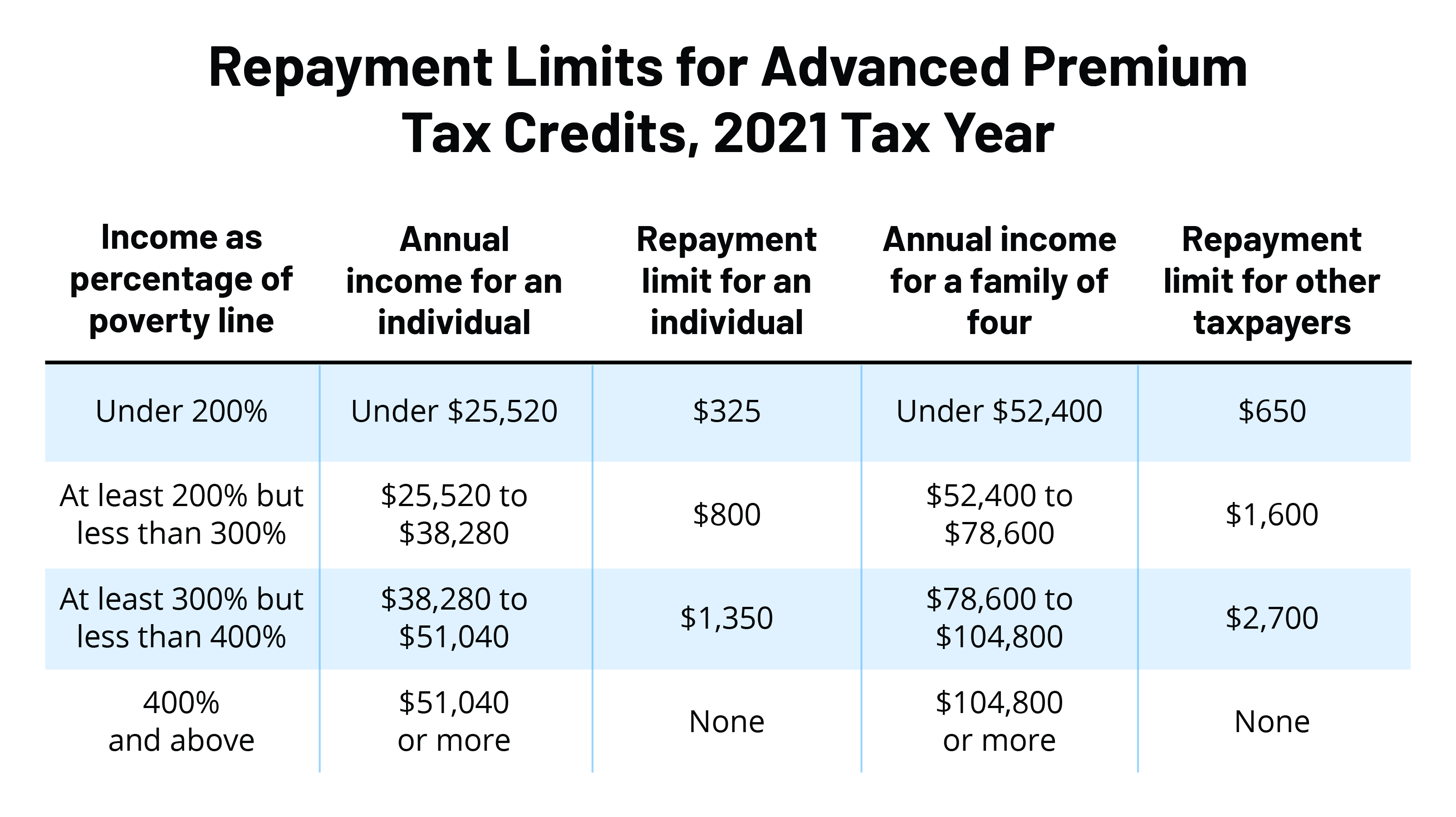

What S The Most I Would Have To Repay The Irs Kff

Tax Credit Definition How To Claim It

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Health Insurance Marketplace Calculator Kff

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning